The Incoming CGT - Everything Businesses Need to Know, So Far

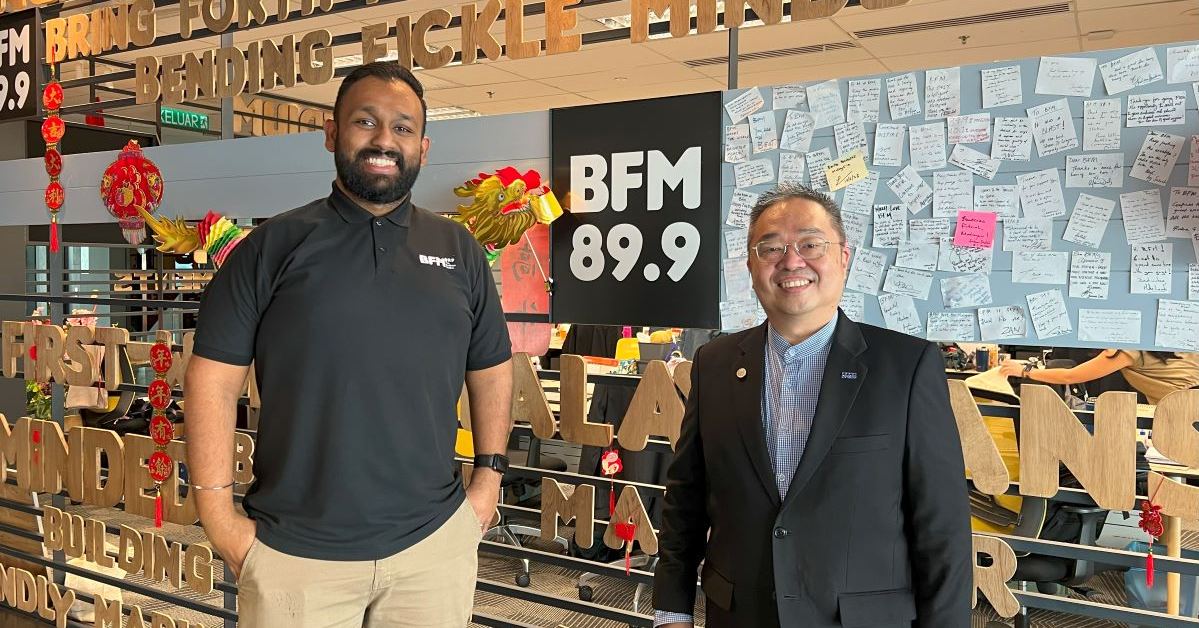

Soh Lian Seng, Head of Tax, KPMG

06-Feb-24 12:00

Embed Podcast

You can share this podcast by copying this HTML to your clipboard and pasting into your blog or web page.

Close

In a month’s time, the domestic component of the Capital Gains Tax announced in Budget 2024 comes into effect. Enterprise Explores Malaysia's incoming Capital Gains Tax (CGT) and what it means for businesses with Soh Lian Seng, Head of Tax at KPMG. We get into who the CGT will impact, how broad its reach and implications are, and exemptions to the CGT.

We also explore what we’ve learnt from the recently published Capital Gains Tax Return Filing (CGTRF) Program by LHDN, the proactive steps that businesses need to undertake to mitigate the potential impacts, and what we know so far about the compliance and reporting requirements for the CGT.

For some background, in Budget 2024, it was announced that a capital gains tax (CGT) would be introduced on the sale of shares in unlisted Malaysian companies and that this would be imposed on the disposal of unlisted shares in a company incorporated in Malaysia by companies, limited liability partnerships, cooperatives and trust bodies. Individuals have been excluded. This would also apply to disposal of shares in a controlled company incorporated outside Malaysia but owns real property in Malaysia, or shares in another controlled company. There are some noted exemptions, including gains on disposals in relation to restructuring within the same group, initial public offerings approved by Bursa Malaysia and venture capital companies (subject to conditions to be stipulated).

This was however just the domestic component of the CGT, that will come into effect from March 1, there is also a foreign component impacting foreign assets that came into effect at the start of this year, imposed on all gains or profits on foreign capital assets — ranging from real property overseas to shares on foreign stock exchanges — at the prevailing tax rate. As highlighted by The Edge in their article earlier this year, the fund management industry brought up concerns regarding the CGT as it looked that, without any further clarification or exemptions, the gains brought back to Malaysia or from unlisted shares in the country will be taxed at prevailing income tax rates, which would impact the returns. Thankfully for the fund management industry, the government agreed to exempt the imposition of capital gains tax (CGT) as well as taxes on foreign-sourced income (FSI) on unit trusts, which was announced by Finance Minister II Datuk Seri Amir Hamzah Azizan in mid-January.

Soh Lian Seng, Head of Tax at KPMG helps us get a clearer understanding of everything businesses should know about the CGT, based on the information we have so far.

Produced by: Roshan Kanesan

Presented by: Roshan Kanesan

This and more than 60,000 other podcasts in your hand. Download the all new BFM mobile app.

Categories: economy, Corporates, markets

Tags: cgt, capital gains tax, budget 2024, lhdn, bursa,